Credit Score Savvy

Credit Score Savvy

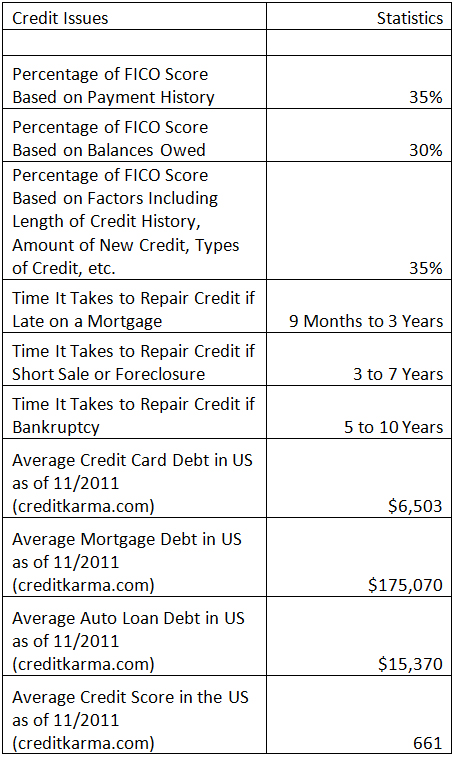

With the New Year, people often make resolutions to fix problem financial situations. Part of cleaning an individual’s financial house includes taking a hard look at his or her credit. Credit Score Savvy (2003) was one of my earlier articles that I wrote for a local magazine. At that time, I was a loan officer and found that many people were confused by FICO scores and credit issues. In the article I explained factors that affected scores and the ability to finance a home. Although the market has changed since then, a lot has remained the same in terms of confusion about credit issues. A more recent article titled Polish up Your Credit includes some information about things people can do to improve his or her credit score now. What may be most useful from this article are some of the statistics. The following chart provides answers to some of the most basic credit-related questions.

Related Articles

Purchasers from Amazon Responsible for StateTaxes

Article first published as Purchasers from Amazon Responsible for StateTaxes on Technorati.

Amazon has enjoyed an advantage over their competition. They have not had to add tax to the purchase amount in states where they don’t have a physical presence. Slate reported, “According to Quill Corp. v. North Dakota, a 1992 Supreme Court ruling, companies are only required to collect sales taxes from their customers when they have a presence in the state in which they reside.”

This has been a sore spot for many of Amazon’s competitors. Many of them feel that if they should have to handle the taxes for customers, so should Amazon. This advantage has made them undersell big competitors like the Apple Store and Best Buy.

Purchasers from the Amazon site may think they are getting a better deal. In reality, there may be taxes owed, but it won’t be by Amazon. What many people in certain states like Arizona don’t know about their purchases on Amazon, is that it is going to be up to them to keep financial records of what taxes are due. At the end of the year, when they file their tax returns, these taxes should be included in any amount owed to the government.

According to the Arizona Republic, “If you buy something online from a retailer who doesn’t have a physical presence in Arizona and they don’t charge state tax or the tax from the state where they’re located, then you’re probably liable for the use tax – the 6.6 percent tax. The safest thing to do is if you buy something online and you get a receipt, save it. It’ll probably show if there was any sales tax from the state where it was charged. If there’s not and there is no Arizona tax, then you should think about paying the use tax on that.”

What if you haven’t kept all of your Amazon receipts? Go to your account page on Amazon and under Order History, click on Download Order Reports. This tool allows you to put in the date range of purchases to request a report of purchased items.

According to Amazon’s site, “Items sold by Amazon.com LLC, or its subsidiaries, and shipped to destinations in the states of Kansas, Kentucky, New York, North Dakota, or Washington are subject to tax.” It is wise to check with your state to see what your tax obligation is. For more information from Amazon regarding taxes, click here.

Related Articles

Our Kids’ Financial Futures Are At Stake

The sky is falling. We hear about it every day. The stock market is plunging, the housing bubble has exploded, and the list of doom and gloom goes on and on. How did we get here? We consider ourselves a bright nation. Why then, didn’t we see this coming? Did we get too greedy? Did we lose our common sense? Perhaps it was a little of both. What is important is what we have learned from our mistakes and the knowledge we pass down to our children to help them avoid a similar fate.

Unfortunately our children may end up sinking in our same boat. Even if they go to college, the personal finance education they will receive will be slim to none. While in college, our children are finding themselves more in debt than any past generations. Think about some of the financial statistics for our youth:

- 76% of undergraduate students have credit cards, while carrying a balance of over $2000, according to Nellie Mae. 28% percent of students roll over their debt each month.

- College graduates are finding that they are over $20,000 in debt, according to Creditcards.com.

- Charles Schwab reported in a 2007 survey that 45% of teens have credit cards but only 26% know how to understand how their fees and interest payments.

Whether we are looking at Generation Y, Echo Boomers, Millenials or any of the other names given to those born after 1982, it is important to understand that they have been raised to expect immediate gratification. Sixty Minutes did a recent feature discussing how companies are even bending over backwards to meet the demands of this high-expectation generation.

If everybody is bending over backward to meet their needs, what is going to happen when they have to be financially responsible for themselves? Why aren’t we bending over backwards to help them learn to be financially independent? We have seen that past generations (their parents) have been poorly educated and are apparently in no position to teach them. If it is not to be taught by parents who are uneducated themselves, where will they get this knowledge?

Currently many colleges and universities are rethinking their position in including personal finance education. Unfortunately these classes are mostly electives or only required by business majors. It costs upward of $6000/year average to pay for a child’s college tuition. What are they getting out of that to prepare them for their adult life?

What can be done?

- Colleges can create more course offerings to include personal finance education. Within the courses, texts need to be appropriate for all majors. Many colleges offer texts for these courses that are math-intensive, which can turn off the student who is not a math genius.

- As parents we can help our children by sharing our mistakes and explaining what we ourselves have learned in the process.

- K-12 Guidelines can be updated to include more specifics as to amount of “time” devoted to the financial literacy information our schools are supposed to be teaching.

- Personal finance books for younger students could be created in a story-telling format that would allow for them to relate the importance of what they are learning to their own lives.

If future generations are not taught to become financially responsible, who is going to bail them out? Are we going to have to just keep relying on the government to come to the rescue? It certainly isn’t going to be their parents, as they have lost their retirement nest eggs. In fact, their parents may be looking at this generation to take care of them.

Guest post by Diane Hamilton, who has a BS, MA and Ph.D. in Business Management. Her experience includes working in several industries including pharmaceuticals, banking and real estate. She has trained corporations in areas such as time management, emotional intelligence and Myers Briggs. She currently works as an online professor, working for 5 different universities. She teaches mostly business-related courses to bachelor, master and doctoral level students as well as mentors doctoral learners. She is in the process of writing a personal finance book for the young adult. Diane can be reached through www.drdianehamilton.com

FHA Calculator

It is easier than ever to know the loan amounts that FHA offers. If you are in the mortgage business, you can get the widget for your website showing loan limits for your state at: http://www.fha.com/fha_loan_limits_widgetcode.cfm.

The amounts shown in the picture above are the actual loan limits right now for FHA loans in Maricopa County, Arizona.

Ask Dr. Diane: Starting Over In Life – How to Catch Up Financially

Today’s Question Is: I am pursuing my Masters. I am divorced, 49 and just starting over in my life. I now have a 30 year mortgage on a home (I look at it as an investment). I really am worried about my future and how well off I will be financially. Starting over has cost me a fortune but personally I am extremely happy, until I think about my future, and then severe anxiety. Not to mention paying student loans. Anyway do you have any resources for women like me? I feel happy that I am an RN and am actually working but I want to be better off financially.