Prezi Presentation about Education That Blows PowerPoint Out of the Water

Prezi Presentation about Education That Blows PowerPoint Out of the Water

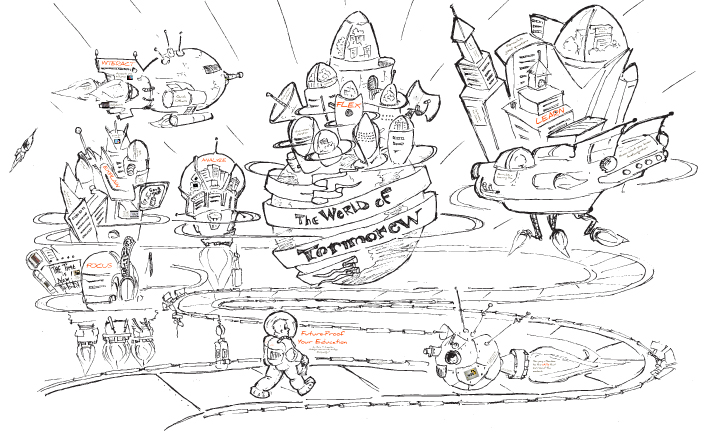

Prezi is a presentation software similar to Powerpoint. Check out this very interesting use of Prezi “Future Proof Your Education” from Maria Andersen where she explains “How do you prepare for uncertain career paths where technical knowledge doubles every two years? You pay attention to the skills that surround the content: Interact, Flex, Learn, Explain, Analyze, and Focus.”

Andersen does a nice job of incorporating the “Did You Know?” video into her presentation while showing how to utilize Prezi to its fullest. Click on the presentation below to find out more about choices and how knowledge and skills can affect career paths. Particularly fun is the “Little Billy” video showing what happened to Billy and others when they entered the workforce and experienced information overload syndrome.

If you have ever wondered how to make the most out of using Prezi, this presentation can show how to do this.

Related articles

Nepotism: Consequences Good and Bad

Nepotism may be frowned on in some companies, but that is not to say that some very famous people have been helped by it. In Latin, nepotis means nephew. Nepotism is now more broadly defined as: When someone gives favoritism to a relative without necessarily basing it on their abilities or merit.

Accountingdegree.com had a very interesting article recently titled: 10 Famous Businesspeople Who Benefitted from Nepotism. This list contained some very recognizable last names including: Forbes, Trump, Hilfiger, Kraft and Walton. The article pointed out the hypocrisy that may exist in terms of when nepotism is considered alright. “At the blue collar level, when friends hire friends or a father expects his children to join the family business, we often believe it’s a sign of strong family values, not unethical or slimy business. But at the executive level — where millions and billions of dollars can be earned — favors are made in secret. It might be tempting to help your children or siblings get a great job, but in the public eye, it’s shameful.”

Viewshound recently wrote about whether nepotism is an unfair advantage or a sensible employment strategy. Whether it was a sensible strategy or unfair practice is something that will be debated in the current lawsuit where Murdoch News Corporation is being sued by its shareholders for buying the chairman Rupert Murdoch’s daughter’s business for $675 million. According to the Huffington Post, “The lawsuit seeks damages and a declaration the board breached their fiduciary duty to shareholders.”

Related articles

- Nepotism: Is it a Boon or Bane for the Organization? (brighthub.com)

New Study Shows Young Adults Find Power in Debt: Lack of Education to Blame

In recent research published in the journal Social Science Research, the data showed that young adults aged 18-27 actually felt empowered by having debt. They felt that it increased their self-esteem and made them feel in control of their lives. Because they were able to attain goals of buying things, they perceived this as a good thing.

ScienceDaily reported, “The study involved 3,079 young adults who participated in the National Longitudinal Survey of Youth 1979 — Young Adults sample. The NLSY interviews the same nationally representative group of Americans every two years. It is conducted by Ohio State’s Center for Human Resource Research on behalf of the U.S. Bureau of Labor Statistics.”

The young adults who had less money to begin with, felt more empowered by this new found ability to purchase things. “Results showed that those in the bottom 25 percent in total family income got the largest boost from holding debt — the more debt they held, both education and credit card, the bigger the positive impact on their self-esteem and mastery.”

The study found that as young adults became older, they had a more realistic idea of what this debt was doing to their lives. By age 28-34, the stress caused by the debt was starting to be felt.

The results of this study back up what has been called a movement toward an instant gratification society. The Arizona Republic reported, “Many young adults might feel good about incurring debt because it lets them purchase desired items without having to delay gratification. They are happy they can actually get credit and feel more like adults now. . .But they don’t actually understand what that entails.”

Eventually the bills start piling up and these young adults will have to face the consequences of paying off what they have charged.

How did this generation get to this point? Lack of education may be to blame. Here is a reprint of an article I wrote several years ago that addressed this problem:

Lack of Education to Blame for Financial Crisis

The current financial crisis is entirely our fault. We are a nation of financially-ignorant people doing crazy things like buying a $450,000 home on a $40,000 a year salary with a 120% loan. How in the world did we think that this was OK? What are we doing to be sure that this won’t happen again? People are sick of reading about bad news and the economy. They’d rather just put their heads in the sand and hope Obama is here to save the day. Well I’m here to tell you, if we don’t change the way we teach personal finance to the youth in our country, we will have learned nothing from this economic disaster and future generations are doomed to repeat our mistakes.

FROM AN EDUCATOR’S PERSPECTIVE

Having taught college business students for many years, I am horrified by the lack of personal finance training our youth receives. Should it be up to the young adult to learn this on their own? There are a lot of books on personal finance out there. If you hang out at a bookstore and watch the type of people who are reading them, however, you will notice it is not the young generation purchasing them. It is usually the 30 and older crowd that has now found themselves in financial straits and want to know how to get out of it. The younger generation doesn’t realize that they need this knowledge yet. Their parents probably never taught them because they probably have a limited understanding of personal finance themselves. How can we expect parents to teach children something they never learned in the first place?

Shouldn’t personal finance be something we learn in high school and college to prepare us for our financial futures? Arizona State University’s W.P. Carey School of Business has a good reputation. I use that as an example because that is where I received my BS in Business. Business Week lists ASU in its 2007 rankings as 66th out of the top 100 business schools. I am not trying to pick on ASU because it is a wonderful school. However, last semester they offered only one course that addressed personal finance and retirement planning. Only three sections of this course were even offered. For one of the largest business schools in the US, there was not much of a focus on educating our youth to be financially savvy. ASU only required that business minors take this course.

I recently ordered the textbook that ASU uses for this course. I love to read all I can read about personal finance; I realize that I am not typical in that regard. However, even with my keen interest in the subject, just looking through this text, I was so bored! If I see the words “net present value of money” . . . even I want to run. I just don’t think that it teaches the types of things young people need to know in a way that would spark their interest. This text is busy with charts, pictures, numbers and balance sheets. A young adult that isn’t savvy in math might get immediately turned off by that. To be fair, this course is offered to business majors who are probably decent in math. However, what about the rest of the students who are not? Why are we only teaching personal finance to business majors? Granted, it is a class that is open to everyone, but it is not required. To me, this text would be a “next level” type of teaching tool for those who understand the basics already. Unfortunately if ASU is typical of what other schools offer, they are missing the boat of what it takes to reach the average student.

Even if some form of money management is taught before college, part of the problem stems with allowing kids to be able to advance through school without passing tests to prove their personal finance knowledge. Dr. Danielle Babb, author, entrepreneur and professor who appears frequently on national television and radio claims, “Kids shouldn’t be allowed to move on if they haven’t mastered the basics.” Unfortunately many are learning about finance the hard way. Right now that may be through watching the collapse of the current economy. As Dr. Babb pointed out, “Right now an entire generation is learning about markets; that they don’t just go up – they can go down, too.”

Paula Zobisch, Ph.D., a well-respected professor who teaches business at ten online universities, agreed that this issue needs to be addressed. When asked how she felt about the personal finance education that our youth is receiving she responded, “Sure, let us lean on the high educational institutions to teach financial management, but let us not also forget high school. And even more importantly, let us remember parents who could teach financial management by giving younger children an allowance and then guiding the management of that allowance. Financial management begins long before college.”

Fox News (2009) reported 48% of high school seniors correctly answered finance and economics questions.

This is not to say that more colleges and universities aren’t realizing the importance of teaching personal finance. In fact, universities such as Lynn University, University of Cincinnati, Kent State, Fairfield University, Scripps College and Texas State all are among the colleges offering courses in personal finance and money-management. However, some universities have had some convenient relationships with credit card companies which seem at odds with teaching fiscal responsibility.

New York Times recently featured a story about how colleges profit from marketing credit cards to their students. Michigan State University came under fire as it was noted that they allowed Bank of America to offer advertising items to their students to sign up for banking and credit services. In fact, according that the New York Times (2008) “Bank America’s relationship with the university extends well beyond marketing at sports events. The bank has $8.4 million, seven-year contract with Michigan State giving it access to the students’ names and addresses and use of the university’s logo. The more students who take the banks’ credit cards, the more money the university gets. Under certain circumstances, Michigan State even stands to receive more money if students carry a balance on these cards.”

If we step back to look at our children’s personal finance education even before college, it is interesting to check out the National Standards (2007) in K-12 personal finance education. The standards define financial literacy as “the ability to use knowledge and skills to manage one’s financial resources effectively for life time financial security”. The standards include areas such as financial responsibility, planning and money management, credit card and debt, as well as saving and investing. Some of the 12th grade goals include having the ability to “analyze how economic, social-cultural, and political conditions can affect income and career potential” as well as “explain the effect on take-home pay of changing the allowances claimed on an employee’s withholding allowance certificate (IRS form W-4). What they don’t really cover is how much time they are devoting to these topics.

The National Standards are created by the JumpStart Coalition for Personal Financial Literacy in Washington, DC.

There are educators and organizations set up that are trying to do something about educating our youth. The DuPont Fund is one of these organizations. In 2008 this organization created a presentation to increase awareness of the lack of financial literacy. In that program, the author addressed the areas that required attention. “There are three parts to a successful financial literacy education program. (1) Quality Financial Education Products (2) Qualified and Trained Financial Educators (3) Evaluation Program in Place to Measure Results” (Lindfield, 2009). If we do not have quality financial education products, then we are limiting the educators’ ability to reach this group of students.

FROM A YOUTH’S PERSPECTIVE

Having two grown daughters and after teaching for 6 different universities online, I personally have not found too many students who can meet many of the required standards. If we have set guidelines for what seems to be admirable goals in educating our youth, why haven’t the graduating high school and college seniors learned these important lessons? There are several reasons. These schools may only be devoting a small amount of time to very important topics. It is also quite possible that personal finance is the last thing on their minds while attending school. They can’t even relate to it yet. Lastly, when and if they actually do receive personal finance training, it is usually in a format that is hard for them to digest.

Many financial websites like Charles Schwab’s have some interesting statistics on how our youth view the importance of personal finance training. “Among the ideas tested, young people believe providing incentives for states to mandate financial education in schools is the most important step the Obama Administration can take to improve financial literacy.” (Schwab, 2009). In fact, studies are showing that facing future demands without a financial education is a source of serious concern for young adults. “Seven in 10 (71%) are “very concerned” about the country’s economic future. More than half (53%) are “very concerned” about their personal financial future” (Schwab, 2009).

The US Census Bureau (2009) predicts there will be 18.4 million college students this fall.

Part of the problem with educating our youth about personal finance is that books on the subject are written in an unfriendly or boring manner. Even the books that are aimed at a young audience can be in question and answer format or simply read like text books. When something is so far-removed from what they deal with on a daily basis as personal finance is in those early years, it must be taught in a way that allows young people to picture themselves in situations that they could relate to. It’s critical to sell them on the idea of the importance of understanding personal finance.

Having been in sales for over 25 years, I learned many tricks for things to do to “sell my point” so that customers would want my solution. When I was in pharmaceutical sales, part of my sales training was to paint a picture in the doctor’s mind. If our youth is taught personal finance through picture painting or storytelling, perhaps they will learn more. Techniques like placing images in their heads are important for the person to get the point you are trying to get across. If I told the doctor to prescribe my drugs because they were good, I got nowhere (this is what the traditional personal finance book does). If I told them that their patient would be calling them at midnight complaining about migraines or inability to breathe if he didn’t prescribe my drugs, then he had a picture and more reason to do it because he didn’t want to be disturbed in the middle of the night. We need to paint the picture of why personal finance is important in students’ minds.

It is important to get the message of personal finance responsibility in front of the next generation so that they don’t end up the way previous generations are now, having to file bankruptcy or losing their homes. By targeting our high school and college students with education that delivers the message in a picture-painted storytelling format to explain the importance of personal finance, perhaps the next generation will avoid the tragedies that we are all dealing with now. To do this, we need to focus on creating educational materials that are delivering the message in a way that allows us to meet the standards that we have set for our youth.

FROM A POLITICAL PERSPECTIVE

Every day there is another article or news story about families facing foreclosures or bankruptcy. According to Realty Trac there were more than 3.1 million foreclosures filed in 2008. Even if people were able to keep their homes, suddenly they are upside down, owing more than it is worth. We have over 3.5 million homeless people in the US. If we are fortunate enough to still have a job . . . that may be all we have. Those of us who had our retirement savings in a 401k are now wondering what we will do when we retire. As we watch our life savings dwindle away with the falling stock market, shouldn’t we be thinking about how we got here and how we could have avoided this in the first place?

RealtyTrac (2009) data shows a steep include in foreclosure activity.

There are foundations and coalitions that focus their attention on such issues. The New America Foundation addresses challenges facing future generations. Their site has had articles addressing the importance of utilizing what we have learned throughout this crisis to teach our youth. “Such moments of financial trouble are teachable opportunities for children and youth to learn about personal finance, and to improve their own money management skills. However, comprehensive strategies for educating children and youth about personal finance so that they can successfully navigate a complex financial market place have not yet emerged.” (Lopez-Fernandini & Murrell, 2008).

The problem is that changing the education system is no easy task. Proposals must be made. Money must be spent. I recently sent a letter to Arne Duncan with the U. S. Department of Education, explaining my concern about the current lack of personal finance education for our youth. I explained I would like to propose a solution. What did I get back? I received a form letter commending my interest in education but politely stating that I should check out the Excellence in Economic Education (EEC, 2009) program already in place. At the site, you can download current information about national programs currently in place. According to the EEC, there was $1,447,267 worth of appropriations available for 2008 allotted to personal finance education. Making grants available is a good start. But what about addressing the problems in the school’s curriculum?

Obviously the current programs are not working. If we are not open to looking at alternative solutions to our current lack of education our children are receiving, aren’t we doomed to repeat our past mistakes? I realize the government has its hands full with the current crisis. However, our government may need to learn from its past mistakes. Isn’t the definition of insanity doing the same thing over and over and expecting a different result? By not addressing the problems within our educational system, we are doomed to repeat our past mistakes.

Related Articles:

Considering Plastic Surgery? Site Lets Patients Share Stories

Sites like HysterSisters have been popular for women who want to get together and discuss their menopause and hysterectomy-related issues. Now there is a site for people to utilize who may be considering plastic surgery. The site MakeMeHeal.com offers a variety of information including everything from post-surgical underwear choices to information about what products may be helpful to heal after specific surgeries.

If a patient is considering eyelid surgery (blepharoplasty) for example, they can go to the link specifically about that procedure to find out details about the surgery including how long it will take to recover, homeopathic remedies for pain relief, what other comfort products are available, and even what makeup works the best as camouflage.

Like the HysterSisters site, the MakeMeHeal site offers a message board. According to their site, “Our plastic surgery message boards are for all of us who want to talk, listen, share, help, and support fellow women and men interested in cosmetic surgery and non-surgical procedures. You can read messages without logging in. To post a message, please log in or register. It’s free…and being a member gives you access to important information.”

The site even offers a directory of doctors. Be aware that the doctors with a lot of information and recommendations may also be advertising on the site. It is important that you research any physician on additional sites. Patients can rate their doctors and even upload their own before and after pictures. There is a “create your photo album” option available for those interested in keeping track of several operations.

I recently asked Dr. Robert Spies, a board-certified plastic surgeon in Arizona what he thought about this site. Dr. Spies stated, “It’s an informative, easy-to-navigate website that provides excellent up-to-date information on the latest plastic surgery procedures.” For additional information about specific operations, see the following links from Dr. Robert Spies, MD at Arizona Plastic Surgical Center:

Facelifts

Breast Augmentation

Liposuction

Tummy Tuck

Non-Surgical Procedures like Botox

Top 5 Things to Know to be a Successful Entrepreneur

The typical entrepreneurial personality has the drive and ambition for success. Like anything in life, though, it is always harder to do something the very first time. This can discourage many new entrepreneurs from taking that initial leap and to start their own business.

I teach several entrepreneurial courses and have put together some important articles that I recommend to my students. The following list contains many of these articles and some of the most important things that entrepreneurs should do in order to be successful:

- Read Success Stories and Attend Lectures: An excellent way to be inspired and learn from other entrepreneurs is to read their success stories. Onlineuniversities.com recently came up with a list of 20 Biographies Every Serious Entrepreneur Should Read. These books include important success stories from Ben Franklin to Sam Walton. Another very important article to read is: 50 Excellent Lectures for Small Business Owners.

- Learn the Truth About Failure: Many entrepreneurs are stalled in their pursuit of success due to their fear of failure. Even some of the most famous entrepreneurs met with failure before success. To find out more about this, check out: 50 Famous People Who Failed Before Becoming Successful. Also see: Famous Business Failures: Is it as Gloomy as it Sounds? Also see: 10 Famous Product Failures and the Advertisements That Did Not Sell Them.

- Learn the Truth About Finances Required: Not all entrepreneurs come from wealthy families. It can be challenging to come up with the funds required to begin a business. Find out how some very famous entrepreneurs became successful in the article: Famous Entrepreneurs Who Hit it Big With Humble Beginnings.

- Learn How Women Have Become Successful Entrepreneurs: Some very successful entrepreneurs have been women. Check out: Most Inspiring Entrepreneurial Women.

- Learn How to Network: One of the best ways to get a product or company known is through social media. Part of an entrepreneur’s success is through finding their customers and their niche. Check out: 5 Top Networking Tips for Small Businesses.

Once an entrepreneur has developed a strong idea of the direction they want to take, they need to work on their feasibility study. Investors will want to see this to be sure that their idea is sound. Another important aspect of creating their new business is deciding on a vision and mission statement. Check out The Top 10 Mission Statements in 2011. Once an entrepreneur has received enough funds to get their new business off the ground, they may want to consider whether or not to go IPO. Many companies like Facebook have waited and not gone this traditional route. Find out Why Companies Are Not Going IPO due to fear of the past dot com crash.