Dr. Diane Hamilton's Blog

A Revolution in Hiring and Working with Eva Andres of Juniper Networks

Entrepreneurs: Funding Options from Kickstarter

Entrepreneurs often find that one of the hardest parts of realizing their dream is to obtain financing. Some have tried microlending sites like Kiva.org. Others have discovered a new lending platform called Kickstarter. The site’s tagline is “a new way to fund and follow creativity.”

Kickstarter describes its site as the world’s largest funding platform for creative projects. This unique site allows entrepreneurs to keep ownership and control over their work while tens of thousands of people pledge millions of dollars to help finance their creative ideas. The idea must reach its funding goal or no money changes hands. Entrepreneurs that receive their anticipated funds, can test concepts without risk.

Kickstarter’s Blog offers advice to those interested in creating a new project. The site allows for people to browse current ideas or to create their own. To begin a new project dedicated to film, art, technology, design, food, publishing and more, creators can check out Kickstarter school.

Once a project is listed on the site, it displays timeline and pledge information including: Percent Funded, Amount Pledged, Number of Days Left to Receive Funds. The picture displayed below demonstrates some examples listed on Kickstarter’s site. On the site’s curated page, it lists “projects curated by some of the world’s foremost creative communities.” The site also allows users to view projects by staff picks, most popular, recently launched, ending soon, small projects, most funded, as well as by category and location.

For additional help with the entrepreneurial process, check out the Top 30 Links for the Successful Entrepreneur.

Related Articles

- Could Augmented Reality Technology Inspire the Next Steve Jobs?

- Top Entrepreneur Topics and Value of the Small Business Administration

- Help with Yelp: Important Site for Small Business

Credit Score Savvy

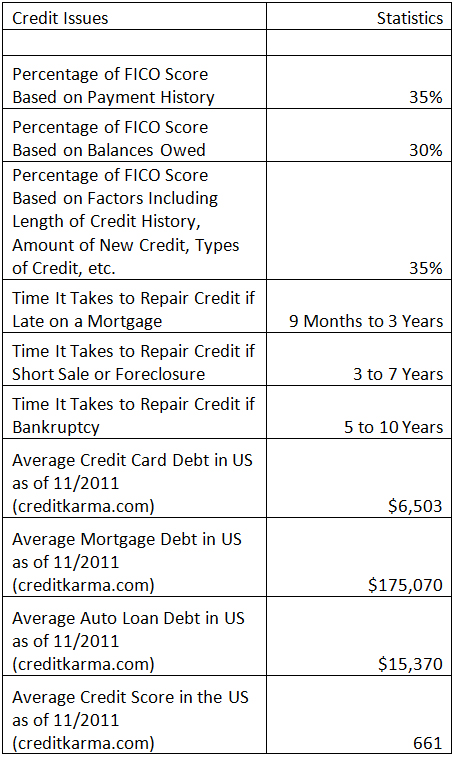

With the New Year, people often make resolutions to fix problem financial situations. Part of cleaning an individual’s financial house includes taking a hard look at his or her credit. Credit Score Savvy (2003) was one of my earlier articles that I wrote for a local magazine. At that time, I was a loan officer and found that many people were confused by FICO scores and credit issues. In the article I explained factors that affected scores and the ability to finance a home. Although the market has changed since then, a lot has remained the same in terms of confusion about credit issues. A more recent article titled Polish up Your Credit includes some information about things people can do to improve his or her credit score now. What may be most useful from this article are some of the statistics. The following chart provides answers to some of the most basic credit-related questions.

Related Articles

Things To Know Before Investing in an IPO

There is a lot of talk about IPOs lately. IPO stands for initial public offering. When a company decides to make shares of the company available to the public, it may sound like a great opportunity to get in on the ground floor. However, it may not be easy or sometimes wise to buy into an IPO as soon as it is offered.

USA Today had an excellent article about Five Things You Should Know Before Investing in an IPO. According to this article, some of these things include:

- Learn the Lingo – Do you know what a red herring is or an IPO offer price?

- It’s Difficult to Get In – It may not be impossible, but you may have to be a preferred client.

- First-Day Investing May Be Risky – If you like the thrill of rolling the dice, the first day can be a wild ride.

- Know the Sales Figures – Find out about the company’s annual sales performance.

- Know the Long-Term Outlook – “The Federal Reserve identified two characteristics of successful IPOs in a 2004 study: The companies have been around longer than other companies issuing stock for the first time, and they’re making a profit before they do so.

To learn more about each of these 5 areas, check out the article by clicking the link listed above.

Related Articles

- Why Companies Are Not Going IPO: Are Skype, Twitter and Facebook Projected IPOs in 2011?

- The Top 10 Most Misunderstood Entrepreneurial Terms

- Top 10 Company Mission Statements in 2011

- Researching Apple: The 10 Most Useful Links

- Famous Entrepreneurs Who Hit it Big With Humble Beginnings

- What to Know Before Investing in IPOs like LinkedIn or Pandora

- Top Five Things to Know to be a Successful Entrepreneur

- 50 Famous People Who Failed Before They Became Successful

- Top 50 Venture Funded Companies for 2011

- Top 5 Networking Tips for Small Businesses

- Time for a New Career? Change the Daily Grind to a Job of Your Dreams

- 50 Excellent Lectures for the Small Business Owner

- An Entrepreneur’s Startup Business Model Checklist

Women Becoming More Successful Than Men

Women are passing men in their abilities to get a degree, handle families and garner success at work. As men are falling behind, women are making huge strides. CNN reported that, “For the first time in history, women are better educated, more ambitious and arguably more successful than men.”

Over half of college degrees are now being awarded to women. “In 1970, men earned 60% of all college degrees. In 1980, the figure fell to 50%, by 2006 it was 43%. Women now surpass men in college degrees by almost three to two. Women’s earnings grew 44% in real dollars from 1970 to 2007, compared with 6% growth for men.”

Women are becoming stronger entrepreneurs as well. Forbes recently reported: “As of 2011, it is estimated that there are over 8.1 million women-owned businesses in the United States. Overall, women-owned firms have done better than their male counterparts over the past 14 years. The number of men-owned firms (which represent 51% of all U.S. firms) grew by only 25% between 1997 and 2011—half the rate of women-owned firms.”

A study by Barclays Wealth and Ledbury Research may have some of the answers to why women are surpassing men. One of the reasons they found is that women are less likely to take unnecessary risks or make rash decisions. The Huffington Post backed up this point stating, “A 2005 study by Merrill Lynch found that 35% of women held an investment too long, compared with 47% of men. More recently, in 2009, a study by the mutual fund company Vanguard involving 2.7 million personal investors concluded that during the recent financial crisis, men were more likely than women to sell shares of stocks at all-time lows, leading to bigger losses among male traders.”

Related articles

- Women Dominating Sales Positions

- Most Inspiring Women Entrepreneurs

- Are Women Making Teams Smarter?

- Female Career Choices That May Surprise You

- 11 Momentous Female Firsts in Academia

Purchasers from Amazon Responsible for StateTaxes

Article first published as Purchasers from Amazon Responsible for StateTaxes on Technorati.

Amazon has enjoyed an advantage over their competition. They have not had to add tax to the purchase amount in states where they don’t have a physical presence. Slate reported, “According to Quill Corp. v. North Dakota, a 1992 Supreme Court ruling, companies are only required to collect sales taxes from their customers when they have a presence in the state in which they reside.”

This has been a sore spot for many of Amazon’s competitors. Many of them feel that if they should have to handle the taxes for customers, so should Amazon. This advantage has made them undersell big competitors like the Apple Store and Best Buy.

Purchasers from the Amazon site may think they are getting a better deal. In reality, there may be taxes owed, but it won’t be by Amazon. What many people in certain states like Arizona don’t know about their purchases on Amazon, is that it is going to be up to them to keep financial records of what taxes are due. At the end of the year, when they file their tax returns, these taxes should be included in any amount owed to the government.

According to the Arizona Republic, “If you buy something online from a retailer who doesn’t have a physical presence in Arizona and they don’t charge state tax or the tax from the state where they’re located, then you’re probably liable for the use tax – the 6.6 percent tax. The safest thing to do is if you buy something online and you get a receipt, save it. It’ll probably show if there was any sales tax from the state where it was charged. If there’s not and there is no Arizona tax, then you should think about paying the use tax on that.”

What if you haven’t kept all of your Amazon receipts? Go to your account page on Amazon and under Order History, click on Download Order Reports. This tool allows you to put in the date range of purchases to request a report of purchased items.

According to Amazon’s site, “Items sold by Amazon.com LLC, or its subsidiaries, and shipped to destinations in the states of Kansas, Kentucky, New York, North Dakota, or Washington are subject to tax.” It is wise to check with your state to see what your tax obligation is. For more information from Amazon regarding taxes, click here.

Related Articles