Credit Score Savvy

Credit Score Savvy

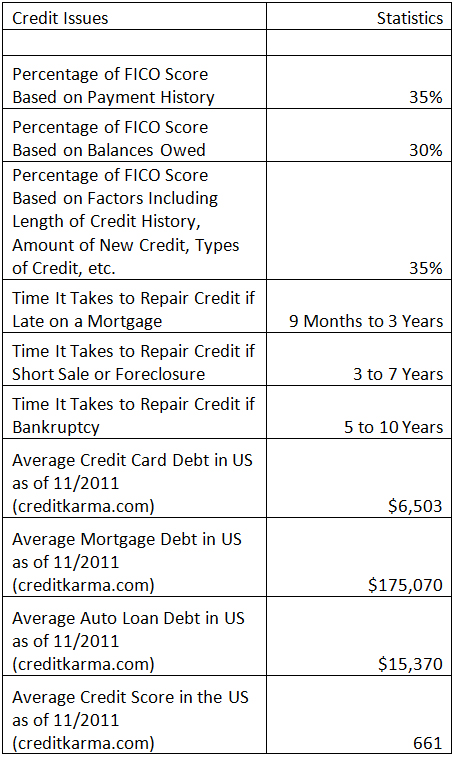

With the New Year, people often make resolutions to fix problem financial situations. Part of cleaning an individual’s financial house includes taking a hard look at his or her credit. Credit Score Savvy (2003) was one of my earlier articles that I wrote for a local magazine. At that time, I was a loan officer and found that many people were confused by FICO scores and credit issues. In the article I explained factors that affected scores and the ability to finance a home. Although the market has changed since then, a lot has remained the same in terms of confusion about credit issues. A more recent article titled Polish up Your Credit includes some information about things people can do to improve his or her credit score now. What may be most useful from this article are some of the statistics. The following chart provides answers to some of the most basic credit-related questions.

Related Articles

Women Dominating Sales Positions

Women are becoming a dominant force in sales positions. In the article 10 Most Lucrative Industries for Women it was noted, “A recent study found that women are coming to dominate certain areas of sales, a traditionally lucrative field for those who excel. In fact, the study seemed to show that women tend to have better selling skills than men, translating into substantial earnings for saleswomen.”

When women were asked what their top 10 more desired sales careers would be, they chose:

2. Biotech Sales

3. Dental Sales

4. Insurance Sales

5. Healthcare Sales

6. IT Sales

7. Medical Sales

8. Advertising Sales

9. Medical Equipment Sales

10. Real Estate Sales

This is good news for women in the current questionable economy. Monster reported, “In 2010, more employers were willing to invest in their sales forces, having some faith that customers could be cajoled into buying. In October 2010 there were 145,000 more workers employed in sales and related occupations than a year earlier.”

For additional resources about women and sales positions, check out some of the following links:

Women Turning to Cosmetic Sales

Community of Women in Professional Sales

50 Best Careers of 2011

Sales Jobs for Women Search Site

Related Articles

- Most Inspiring Women Entrepreneurs

- Are Women Making Teams Smarter?

- Female Career Choices That May Surprise You

- 11 Momentous Female Firsts in Academia

Retired for Hire: More Seniors Working, Shopping, Donating and Spending

A report released last week from Scarborough.com showed in 2010 that 6.2 million people over 65 are working. This group has been referred to as the Retired for Hire. Many of these workers are not in dire financial straits either. In fact this report showed, “Adults over the age of 65 who are still working full-time or part-time are slightly more likely than the average adult to have an annual household income of $150K or more.”

This report has some interesting profile information about this group including:

- They were financially in good shape with an average income over $150K

- Of those working, 57% worked part time and 43% worked full time

- 22% of them shopped at Wal-Mart in past 3 months

- They were 30% more likely to donate to green causes

- They were avid patrons of the arts

- They were 92% more likely to have donated to political organizations

- They were just as likely as the normal population to go to the gym

- 48% of them were into gardening

- Their use of HDTV’s is up 150%

- 80% had desktop computers

- They were more likely to spend money on home improvements

- 41% made a purchase at Home Depot in the last year

Scarborough concluded, “The 6.2 million adults working past retirement age in America tend to be financially sound, with robust investment portfolios and higher than average incomes. This suggests that financial service providers such as banks, investment firms and personal services such as accounting firms and financial planners have a robust marketing target in Retired for Hire.”

Related Articles

- Questions on Working in Retirement (online.wsj.com)

Does Your Boss Want You Dead?

I teach several ethics courses where we discuss ethics in the workplace. Did you know that your employee can take out a policy on your life without you knowing about it? Check out this article by Liz Pulliam Weston from MSN.

‘Dead peasants’ insurance pays your employer a secret, tax-free windfall when you die. Insurers have sold millions of policies to companies such as Dow Chemical.

Right now, your company could have a life insurance policy on you that you know nothing about. When you die — perhaps years after you leave your employer — the tax-free proceeds from this policy wouldnt go to your family. The money would go to the company.

Whats more, the company might use this policy to pay for retirement benefits and other perks not for you or your fellow workers, but for your companys top executives.

Sound outrageous? Such corporate-owned life insurance is also big business:

- Companies pay a whopping $8 billion in premiums each year for such coverage, according to the American Council of Life Insurers, a trade group.

- The policies make up more than 20% of the all the life insurance sold each year.

- Companies expect to reap more than $9 billion in tax breaks from these policies over the next five years. The policies are treated as whole life policies. So, companies can borrow against the policies (though the IRS won’t let them write off the interest). And the death benefits are tax-free.

Hundreds of companies — including Dow Chemical, Procter & Gamble, Wal-Mart, Walt Disney and Winn-Dixie — have purchased this insurance on more than 6 million rank-and-file workers.

These policies, nicknamed dead janitors or dead peasants insurance, soared in popularity after many states cleared the way for them in the 1980s. Congress recently tried to crack down on the practice, to the howls of the insurance industry — which earlier this year managed to derail reforms.

The policies have generated lawsuits by survivors who got little or nothing when insured workers died. A couple of examples: