Are You Super Hungry? Create An Abundant Lifestyle With Jeff Badu

Are You Super Hungry? Create An Abundant Lifestyle With Jeff Badu

Are you super hungry? In this episode, you’ll discover how to get infinite resources to create an abundant lifestyle. Dr. Diane Hamilton’s guest today is Jeff Badu, the Founder and CEO of Badu Tax Services, LLC. Jeff shares with Dr. Hamilton how the scarcity mentality can push people to a life of crime and violence. He witnessed it firsthand in his younger years. Today, Jeff is passionate about helping people open up to abundance. He teaches financial literacy skills you need to build your wealth and become free. Tune in and create abundance!

Continue reading “Are You Super Hungry? Create An Abundant Lifestyle With Jeff Badu”

Lessons And Secrets Around Wealth That Only The Wealthy Knows With Chris Naugle

Nothing beats experience as the greatest teacher. Before becoming America’s #1 Money Mentor, Chris Naugle went from having money, losing it, and figuring out what he was doing wrong. In this episode, he joins Dr. Diane Hamilton to share his roller coaster of a journey while imparting great lessons around wealth. Chris is a highly sought-after speaker, author, the CEO and founder of The Money School™, and Money Mentor for The Money Multiplier. Here, he lets us in on his book, Mapping Out the Millionaire Mystery, to reveal the secrets of the wealthy—many of which are complete opposites of what we have been taught. Chris also takes us into the world of real estate, exploring deeper the ‘buy low, sell high, and don’t lose money’ philosophy. What is more, he dives into the current market situation, learning to become your own bank, finding where to invest in, and other wealth-building strategies that could come in handy in these fast-changing times.

Continue reading “Lessons And Secrets Around Wealth That Only The Wealthy Knows With Chris Naugle”

Making A Difference In Women’s Lives with Vivian Glyck and Teaching Women Real Estate Investing with Monick Halm

Basics Every New Home Buyer Should Know

It may not be as easy to purchase a new home in today’s real estate market. I teach real estate courses, I have a real estate license, and I spent years working in the lending industry. Because of that, people often ask me about what a home buyer should know about the process.

When I was a loan officer, the market was considerably better. First time home buyers had more options. Currently banks are hesitant to lend and buyers need to come up with more funds on their own. In the past, it wasn’t unusual for banks to lend at least 95% of the cost of the home. Now it isn’t unusual for banks to only cover 80% of the cost. FHA loans offer higher percentages but the amount you can borrow is limited.

Getting the Loan

As a loan officer, I did a lot of first time home buyer seminars. At those seminars, people had a lot of questions about the home-buying process. A big part of what they wanted to know was how their credit score affected their ability to get a loan.

A person’s credit score is extremely important in the loan process. The score alone does not dictate whether you will get the loan, but it is a big piece of the puzzle. Banks will also look at your work history, income and how much money you have for the down payment.

If you have a poor credit history, it doesn’t mean that will hurt you forever. As time goes by, your poor credit history fades if you do the right things and is replaced with good payment history. Your credit score should not vary that much from month to month. However, if you have had late house payments in the past or a bankruptcy, it can drop your score more quickly than other things. Improving your score takes longer than hurting your score. It isn’t common under normal circumstances for a score to change 20 points in a few months’ time.

That is why it is important to periodically check your credit report and contact the credit agencies if there is incorrect information on it. There are three main credit agencies: Equifax, Experian and Transunion.

If you report an error to these agencies, they must investigate it and respond to you within 30 days. Sometimes certain information will show up on one agency report and not on another. In order to get information removed from all of them, you need to contact all of them. Don’t assume that because you take care of contacting one agency, that the others will be corrected automatically.

Your score is sometimes referred to as a FICO score, which stands for Fair Isaac and Co., the software company that developed the score. In order to have a FICO score, you must have at least one account that has been open for 6 months or longer. Also, there has to be one account that has been updated in the past 6 months. The higher your score, the better risk you are and the more likely a bank will lend you money.

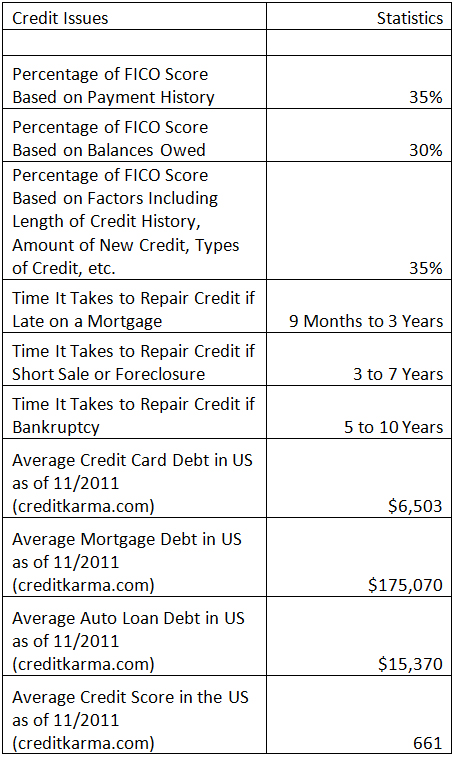

There are 5 main categories of information that are taken into account in determining your FICO score:

• Payment history accounts for about 35 percent of the score. Do you pay your bills on time? Are there any collections or bankruptcies? Bankruptcies will stay on a report for seven to ten years, depending on the type.

• Amounts owed accounts for about 30% of the score. How much do you pay on your accounts? How high of a balance do you have? How much of the credit granted do you actually taken advantage of?

• Length of credit history accounts for about 15%. How long have your credit accounts been established?

• New credit accounts for about 10%. How many recent requests for credit do you have?

• Type of credit accounts for 10%. What kind of credit mix do you have? Do you have credit cards, retail cards, mortgages, etc? You don’t have to have all types, and it isn’t a good idea to have accounts that you don’t use. However, it is worse to close an account that you don’t use than to leave it.

Here are some tips you can use to raise your credit score:

• Pay on time.

• If you missed payments, get current.

• Paying off a collection doesn’t remove it from your report, though it does improve your score.

• Contact creditors if you are having trouble making payments to see if they can help you.

• Don’t maximize how much you take out on your accounts. Keep balances as low as possible.

• Don’t move debt around unless it means you’ll be getting a lower interest rate. You still owe the same amount of money.

• Don’t think closing unused cards will raise your score.

• Don’t open a lot of cards just to have available credit.

• Don’t open too many new accounts too quickly.

• If you have had problems, re-establish new credit history.

• Check out your credit score from time to time.

• Only get new credit cards as needed.

• Manage the cards you have responsibly.

• A closed account will still show up on your credit report.

When people came to me to apply for a loan, I would ask them if I could run their credit. That is what you can expect a loan officer to do as well. They have to know what your credit is in order to know if you will qualify for the loan. Although many people are worried that their credit will affect their credit score, one inquiry will take less than 5 points off of their score. Rate-sopping can cause multiple requests on a report, but as long as the inquiries are within a 14-da6 period, it will only count as one inquiry as far as points taken off. Also the score ignores all inquiries made during the 30 days prior to scoring, so if you find a loan within 30 days, those inquiries will not affect your score while you are shopping.

What is a good score? Traditionally lenders usually liked to see at least 620 to get better rates. Scores over 700 sometimes can get even better rates. If your score was under 620, you could still get a loan, but you would pay a higher interest rate. The numbers change as programs change, but it is a good idea to try and keep scores as high as possible.

Once you get into a house and have house payments to make, whatever you do, do not be late on it. That is one of the worst things you can do to your credit. Should you be late with a house payment, the next time you go for a home loan, the bank is less likely to forget that tardiness than a late credit card payment. Having one late house payment in the last 12 months prior to applying for a home loan can severely affect your ability to qualify for a home loan. If you have a 30 day late payment in the last year, you will have to pay a higher interest rate on your new loan, which could cost you many thousands of dollars. Many lenders offer automatic withdrawal from your checking account. If you have problems remembering to pay your payments, I highly recommend calling your bank and signing up for that service.

Finding the Agent

The first part of the home-buying process is actually getting pre-approved for the home loan. It is only after you have received that, that you can actually start looking for a home. If you don’t have a real estate agent, you might ask your lender to recommend someone.

Another good place to find an agent is by asking friends and family. If they haven’t really had a chance to use anyone yet, you might drive through neighborhoods where you are interested in buying and see if there are any signs up of agents in the area. If you see several signs with a certain agents name on it, it probably means they know the area well and may be a good person to contact.

Remember you do not need to stay with a real estate agent or loan officer that you do not like. You have the right to drop them. They are working for you and if they make you feel uncomfortable or aren’t responsive, you should exercise your right to pick someone else.

The good news about being the home buyer is that the home seller is the one who pays the real estate agent. Your agent will receive a commission for helping you but it will not have to come from you.

Protecting Yourself

There are a lot of things you can do to protect yourself in the home-buying process. Your agent should help you with home inspections and direct you to appropriate insurance agents if you don’t have one.

The Important Things to Remember

Here is the minimum you should know about Home Buying and Renting:

• If you can afford to buy, there are tax advantages over renting.

• Understand what constitutes a FICO score.

• Fix any bad things you have on your FICO score by contacting all 3 credit agencies.

• Get preapproved for a loan before ever looking at homes.

• Find a real estate agent through referral or through checking out neighborhoods where you are interested in buying.

• If you don’t feel comfortable with your agent, get a new one.

• Remember the home buyer does not have to pay the real estate agent.

• Protect yourself with home inspections and insurance.

Related Articles:

Credit Score Savvy

With the New Year, people often make resolutions to fix problem financial situations. Part of cleaning an individual’s financial house includes taking a hard look at his or her credit. Credit Score Savvy (2003) was one of my earlier articles that I wrote for a local magazine. At that time, I was a loan officer and found that many people were confused by FICO scores and credit issues. In the article I explained factors that affected scores and the ability to finance a home. Although the market has changed since then, a lot has remained the same in terms of confusion about credit issues. A more recent article titled Polish up Your Credit includes some information about things people can do to improve his or her credit score now. What may be most useful from this article are some of the statistics. The following chart provides answers to some of the most basic credit-related questions.

Related Articles