10 Most Important Steps to Obtain Dream Job

10 Most Important Steps to Obtain Dream Job

I often speak to students and career groups about how to obtain a dream job or reinvent a career. I have listed some of the most important points from my lectures, with appropriate links to articles, to explain the process. Be sure to click on the links listed under each step to watch videos and read the articles to get step by step instructions.

- Define Your Goals: People fear making mistakes. Although it can be argued there are no mistakes, only learning experiences, part of avoid mistakes is to have good goals. The goals must be measurable with timeframes listed for when you wish to achieve those goals.

- Analyze “You” as the Product: To get a job, you must showcase your talents by thinking of “you” as the product. When you are networking and interviewing, you are “selling” a product and that product is you. Be sure to analyze your online reputation. You can be sure that companies will check on this.

- Create a Personal SWOT Analysis: SWOT stands for strengths, weaknesses, opportunities and threats. By creating a personal SWOT analysis, you can work on capitalizing on your strengths and find solutions for any weaknesses or threats.

- Analyze Your Competition: When you are interviewing, you must remember there are a lot of others that are competing for the same job. Think of those things that you bring to the table that your competition does not. What do others have that you need to be working on in the meantime? Have you done your research? If an interviewer asks you the question: “Why did you pick our company?” . . . do you have a good answer? Know the answers to difficult job interview questions.

- Capitalize on Personality Skills: Part of finding the right job is based on understanding your personality preferences. Personality tests like Myers Briggs MBTI can be very helpful in leading you to the right job. It is also important to work on developing emotional intelligence. Find out why employers are placing as much value on EQ as IQ.

- Analyze Jobs: Find out what jobs pay: One of the first steps is to find out what a job is worth. Consider what types of jobs motivate you. Check out top 10 ways to find a job or have a job find you.

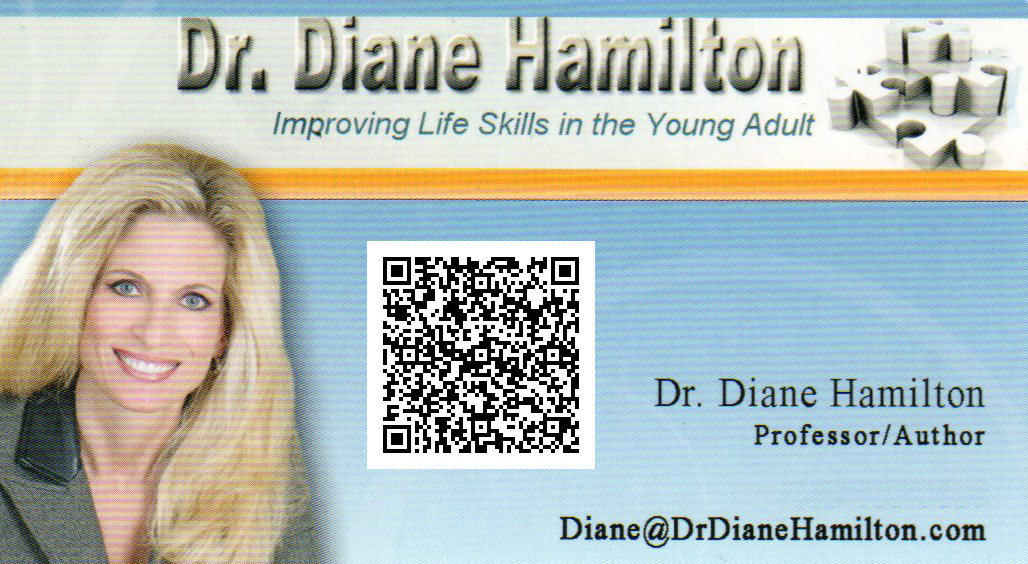

- Showcase Your Talents: Use social networking to get noticed. Find out how you can use a simple PowerPoint presentation and Camtasia to showcase your abilities. If you are not on LinkedIn, you should be. Use Google Docs and LinkedIn to get noticed. Rev up your business card by adding a QR code to it. Avoid putting these top 10 wrong things on resumes.

- Ace the Interview: Once you are able to obtain an interview, use personality skills to wow them. Deliver information in the job interview based upon understanding introverts and extroverts. Keep in mind the proper answer to tough interview questions.

- Follow up on the Interview: Always follow up with a thank you note. It is important to stand out from the crowd and having manners is very important. It is important to realize that millennials have unique job expectations and may not come across as respectful at times.

- Use what You Have Learned to Succeed: Continue to use the things you have learned in order to obtain the job. Don’t stop setting goals. Stay connected through social networking in case the job doesn’t work out.

Related articles

- Increasing Motivation, Right vs. Left Brain, MBTI and Who Will Rule the World (drdianehamilton.wordpress.com)

Social Media Presence Able to Continue Virtually After Death

Adam Astrow stated some interesting social media statistics in his recent TED.com presentation titled After Your Final Status Update. His talk was about what happens to your social media presence after you die and whether it can be saved in a virtual personality.

He cited some pretty interesting numbers for how much data is being uploaded to Youtube, Twitter and Facebook and claimed that that data could possibly be used to create a presence after one has passed away.

He pointed out that there are already some sites and apps that can create postings for people post-mortem. There is an “If I Die” app can that can create video to be posted on Facebook after one’s death. There is a site called 1000 Memories that states, “1000memories is a free site that celebrates the lives of people who matter most – our friends and family, past and present. We help bring the albums, scrapbooks, and photo-filled shoeboxes of our lives out of the closet and into an online, shareable space where they can be remembered and celebrated, together in one place.”

Although one may have passed on, their lives can be remembered indefinitely through the use of technology.

Related articles

How to Use QR Codes on Your Resume and Business Cards

QR codes are the latest thing in marketing. They are in the newspapers, on billboards and on just about every kind of marketing material you can imagine. Now you can utilize this amazing new technology to make your business card and/or resume stand out from the rest. This is an innovative way to show prospective employers that you are tech savvy. It also can redirect them to important information on your website that you cannot include in your resume.

Here is an example of how to put one on your business card.

Anyone with a smartphone that has an app for reading QR codes can easily point their phone at your card and find out more information about you. If you don’t have a QR reader app on your phone, they are easy to download from sites like iTunes and they are free. I use QR Reader for iPhone. Once you have the app on your phone, open it, and point the phone’s camera at the square on my card. See how it directs you to a site.

The QR codes are simple to create. Check out this article: how to create your own QR codes.

Here is an example of how to include them on your resume:

If you used your reader to scan these codes listed here, you can see they each will send you to a different site. You may just want to send them to your LinkedIn page or some other website that showcases your abilities. You could create a presentation in Google Docs or on YouTube that would make you stand out from the crowd. If you have always felt that you could get that job if only they could see you, now is your chance. Just be careful to create quality content on the site where you direct potential employers.

To see QR codes in action, check out this video about how QR codes are changing the way people shop:

[youtube http://www.youtube.com/watch?v=fGaVFRzTTP4&w=420&h=345]Related articles

Value of Top Companies

The following is a list of the estimated value of some of the top companies in 2011. They are listed in order of highest to lowest value.

Apple – TechCrunch recently reported that Apple’s value is now worth as much as Microsoft, HP and Dell combined. Valued at over $300 billion, Apple continues to grow. For more specifics, click here: Apple Value

Microsoft – Recent estimates put Microsoft’s value at about $200 billion. Skype – Microsoft’s recent purchase assessed Skype’s value at $8.5 billion.

Google – Google’s value has been estimated to be $192 billion as of January, 2011. For more specifics on this income including Larry Page and Sergey Brin’s net income, click here: Google Value. Youtube – Recent estimates put Youtube’s value around $1.3 billion. Google paid $1.6 billion for Youtube in 2006.

Facebook – Facebook was valued at $82.9 billion in January and that number continues to grow.

Amazon – In January, it was reported that Facebook passed Amazon’s value. Amazon still showed a $75.2 billion worth. For more specifics, click here: Amazon Value

HP – Recent estimates put HP’s value at about $72.8 billion.

Dell – Recent estimates put Dell’s value at about $29.3 billion.

Groupon – Recent estimates put Groupon’s Value at as much as $25 billion.

Twitter – It is suggested that Twitter’s value is around $7.7 billion.

Linkedin – Recent estimates put LinkedIn’s value at over $4 billion.

Related articles

- Top Company Mission Statements 2012

- Why Companies Are Not Going IPO: Are Skype, Twitter and Facebook Projected IPOs in 2011?

- Net Worth Search Site

What to Know before Investing in IPOs like LinkedIn or Pandora

Is investing in an initial public offering (IPO) a good idea? With the recent LinkedIn and Pandora IPOs and talk of future IPOs with Twitter and Facebook, this is a question that many investors may be considering. Imagine getting in on the ground floor of a giant like Coca-Cola? It might have been a wild ride, but those that hung in there, had a nice payoff. Joshua Kennon of About.com reported, “A single share of Coca-Cola purchased for $40 at the IPO in 1919, for example, crashed to $19 the following year. Yet, today, that one share, with dividends reinvested, is worth over $5 million.”

Kennon suggests that if you have the stomach for risking your investment, you might want to consider whether the company can grow at a rate high enough to justify its price, whether there are any patents or trademarks to protect the business, whether you’d want to hold onto this stock for 30 years and if it fell by 50% would you have the stomach to handle it?

DailyFinance reported some additional questions to ask before investing in an IPO: (1) Is there an attractive market for the product? (2) Does the company have a significant share of the market? (3) Is the company’s management team experienced? (4) Is the company growing and profitable?

The following list shows some more recent IPO original offering prices compared to their current price (as of July, 2011):

Google Initial Offering Price, 2004: $85/share

Google Price July, 2011: $530/share

Pandora Initial Offering Price, June, 2011: $16/share

Pandora Price July, 2011: $19/share

LinkedIn Initial Offering Price, May, 2011: $45/share

LinkedIn Price July, 2011: $98/share

Many employees of companies like Google became wealthy overnight when their companies went IPO. The New York Times article Google’s IPO 5 Years Later stated, “When the offering finally happened, it turned an estimated 1,000 Google employees into millionaires, at least on paper. Since then, many more millionaires have been minted inside the Googleplex, the Web search company’s headquarters in Mountain View, Calif.”

Not all startups have been this successful. Businesspundit lists the 25 Internet Startups that Bombed Miserably. MSMoney also warned, “Many investors fret they’ll miss the next big thing because they have no access to the IPO market, but study after study has proven that IPOs historically underperform the broader markets.” FIGuide echoed that same sentiment in their article Should You Invest in IPOs, stating that there might be better options. “A seminal paper published in The Journal of Finance looked at IPOs from 1970 to 1990. During the five years after issuance, investors in these IPOs got average annual returns of only 5%.(1) By contrast, the overall stock market’s average annual return from 1970 to 1990 was more than double that figure, at 10.8%. To put this in perspective, $1,000 invested at 5% for 20 years would have generated $2,653, while $1,000 invested at 10.8% would have generated $7,777, almost three times as much.”